MARKET OPPORTUNITIES

The Polymers Market accounted for US$ 522.7 billion in 2020 and is estimated to be US$ 838.5 billion by 2030 and is anticipated to register a CAGR of 5.3%. Polymers are used widely all over the world in every variety of industries (Globe Newswire, Sept. 12, 2022).

The Global Bioplastics Market was valued at USD 11.2 billion in 2021 and is projected to be worth around USD 46.1 billion by 2030 with a CAGR of 17.02% from 2022 to 2030. (Precedence Research, September 19, 2022).

MARKET SIZE

The US Bioplastics Market Size is estimated to be worth around USD 46.1 Billion by 2030

(Precedence Research, September 19, 2022).

The Global Polymers Market Size is expected to grow from USD 713.9 Billion in 2021 to USD 1078.5 Billion by the end of 2030

(Precedence Research, September 19, 2022).

MOLDED PULP

PACKAGING MARKET

According to a new market research report, the “Molded Pulp Packaging Market by Source Type (Wood & Non-wood), Molded Type (Thick Wall, Transfer, Thermoformed, Processed), Product (Trays, Bowls, Cups, Plates, Clamshells), End Use, and Region – Global Forecast to 2024”, The molded pulp packaging market size is projected to grow from USD 3.5 billion in 2019 to reach USD 4.4 billion by 2024, at a CAGR of 4.4%.

The molded pulp packaging market is expected to witness high growth due to factors such as the rise in the middle-class population; growth in demand from the food packaging, electronics, healthcare sectors; and preference for convenient & sustainable packaging in the market. In addition, an increase in demand for protective and convenient packaging in the electronics sector is influencing the growth of the market.

The transfer molded packaging segment, by molded type, to gain the maximum share of the market during the forecast period

The transfer molded packaging segment is projected to account for the largest share by 2024, mainly because of the growth in consumption of transfer molded packaging in the food, foodservice disposable, healthcare, and automotive industries. Transfer packaging is most commonly used in the manufacturing of egg cartons, trays as well as fruit, food, & serving trays in the foodservice industry. This is due to the rise in consumption of convenient, recyclable, and sustainable packaging products for which molded pulp packaging is used, especially in the emerging markets of Asia Pacific and South America. The increasing demand for sustainable food disposables from the foodservice disposable industry provides a growth opportunity for the molded pulp packaging market.

Asia Pacific projected to be the largest shareholder in the molded pulp packaging market by 2024

The molded pulp packaging market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. The Asia Pacific region is estimated to account for the largest share among all the regions in 2018 and is projected to grow at the highest rate from 2018 to 2024, in terms of value. This can be mainly attributed to the increase in demand for molded pulp packaging in China and India, coupled with the growth in the food packaging and healthcare industries in these countries. The urbanized population is shifting its preference to convenient, healthy, and safe packaged foods owing to the rise in disposable incomes.

POST-CONSUMER

RECYCLED PLASTICS MARKET

According to a new market research report, the “Post-consumer Recycled Plastics Market by Polymer Type, Service, Processing Type (Mechanical, Chemical, Biological), End-use Application (Packaging, Building & Construction, Automotive, Furniture, Electronics), and Region – Global Forecast To 2025”, The global post-consumer recycled plastics market size is projected to grow from USD 14.2 billion in 2020 to USD 18.8 billion by 2025, at a CAGR of 5.7% from 2020 to 2025. The increasing urban population, rapid industrialization, growing concern toward the environmental impact of the improper disposal of plastic waste, along with laws & regulations regarding the disposal and treatment of plastic waste, have propelled the growth of the global plastic waste management industry. The increase in the GDP of a country will enable it to work with more advanced and effective waste management solutions, which will, in turn, increase the demand for waste management services, equipment, and technologies.

COVID-19 impact on global post-consumer recycled plastics market

Various plastic recycling companies are finding ways to communicate with their customers to help assure them in these difficult times by providing information on their website and social media on how they are tackling the global challenges faced by the company. Various plastics recyclers are not only ensuring the safety and quality of their raw materials but also the health and well-being of their employees.

The COVID-19 situation has slowed down the growth of the plastics recycling industry owing to the social distancing and lockdown imposed by various countries across the world. These measures to fight the pandemic have created disruption in the supply & demand chain. The collection, sorting, and recycling process has been hampered owing to the impact of COVID-19 on the industry.

PP is estimated to be the fastest-growing segment in the post-consumer recycled plastics market from 2020 to 2025.

PP, by polymer type, is estimated to be the fastest-growing segment in the post-consumer recycled plastics market from 2020 to 2025, in terms of volume. Products made from PP offer high stiffness, heat resistance, steam barrier properties (food protection), elasticity (film and fiber applications), enhanced transparency, strong impact & rigidity balance. The resistance of PP to permeation is equivalent to or marginally better than that of high-density polyethylene (HDPE) and superior to low-density polyethylene (LDPE). It is recyclable and reused in various applications besides manufacturing plastics. These properties have led to an increasing preference for PP in the manufacture of packaging units used in the food & beverage, pharmaceutical, electronic, and packaging industries. Few packaging applications include bottles, crates, films, and pots.

The APAC region is projected to account for the largest share in the post-consumer recycled plastics market during the forecast period.

The APAC region is projected to lead the post-consumer recycled plastics market, in terms of both value and volume from 2020 to 2025. The growing population, rising GDP, and increasing disposable income in APAC are leading to the generation of more solid waste, which, in turn, is creating opportunities for plastic recycling in the region. According to the OECD Development Centre’s Medium Term Projection Framework (MPF-2019), GDP in the emerging Asian region is projected to grow by an annual average of 6.1% between 2020 and 2025.

BIODEGRADABLE PLASTICS MARKET

According to a new market research report, the “Biodegradable Plastics Market by Type (PLA, Starch Blends, PHA, Biodegradable Polyesters), End Use Industry (Packaging, Consumer Goods, Textile, Agriculture & Horticulture), and Region (APAC, Europe, North America & RoW) – Global Forecast to 2026”, The global biodegradable plastics market size is projected to grow from USD 7.7 billion in 2021 to USD 23.3 billion by 2026, at a CAGR of 24.9% between 2021 and 2026.

Biodegradable plastics are used in various industries, such as packaging, consumer goods, textiles and agriculture & horticulture. However, due to the ongoing pandemic, the industries had been affected throughout the world. Manpower shortage, logistical restrictions, material unavailability, and other restrictions had slowed the growth of the industry during the previous year. Due to the outbreak of the Covid-19 pandemic and its gradual spread, industries of essential needs, like getting foods and required supplies safely to the consumers are increasingly affected. The global impact has led to sharp reduction in demand for some types of packaging which are condemned as non-essential.

PLA is the largest type segment of the biodegradable plastics market, as it is used in various end-use industries such as packaging & bags and consumer goods. PLA is made from renewable resources, and it is compostable as well as biodegradable. It is derived from corn starch (in the US and Canada), tapioca roots, chips, or starch (mostly in Asia), or sugarcane (in RoW). This makes PLA non-toxic and environmentally friendly material. The key applications of PLA are thermoformed products, namely, drink cups, takeaway food trays, containers, and planter boxes. It has good rigidity and allows for replacement of polystyrene and PET in such applications. PLA is being adopted rapidly as it is more economical to manufacture compared to other biodegradable plastics.

Europe is estimated to be the fastest-growing market for biodegradable plastics between 2021 and 2026.

Europe is estimated to be the fastest-growing market for biodegradable plastics between 2021 and 2026. The political and economic conditions have driven the market penetration of biodegradable plastics. The strict government norms and economic conditions have also driven the biodegradable plastics market. These factors have been responsible for the development of biodegradable plastics with collaborative research in the region.

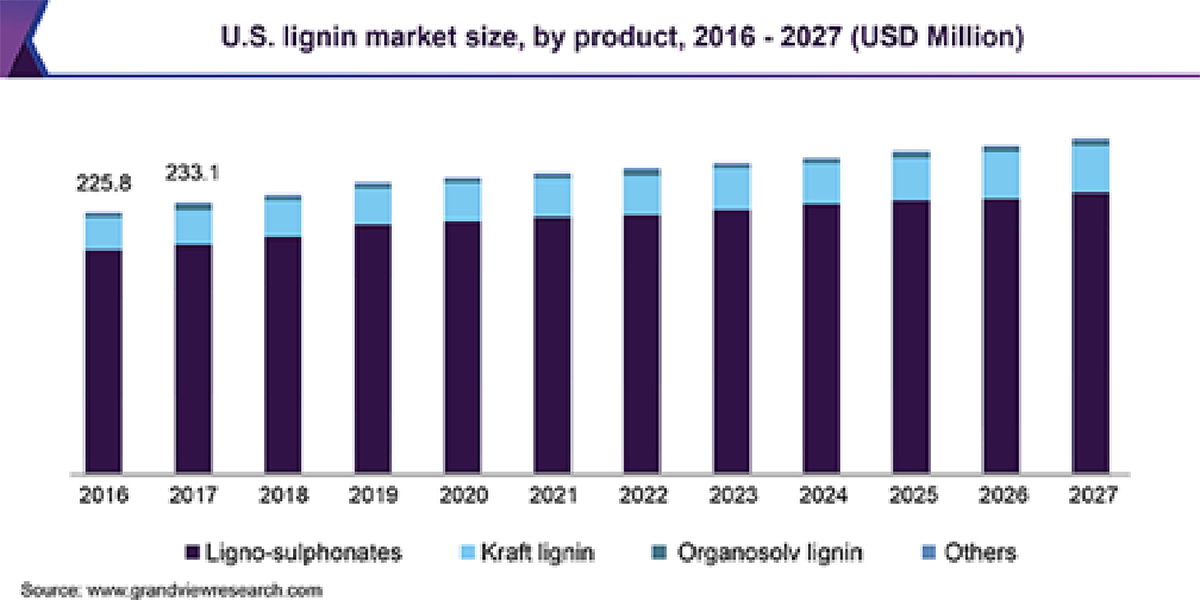

The global lignin market size was estimated at USD 954.5 million in 2019 and is expected to expand at a CAGR of 2.0% in terms of revenue, from 2020 to 2027. Increasing demand for lignin in animal feed and natural products is anticipated to drive the growth. The product is widely utilized in the production of macromolecules used in the development of bitumen, biofuels, and bio-refinery catalysts. This factor is likely to support market growth. Growing demand for concrete admixtures and adhesives and binders coupled with increasing investments in infrastructure development is expected to fuel the market growth.

In U.S., the demand for lingo-sulphonates accounted for the largest market share of 85.5% in 2019 and is expected to expand at a CAGR of 1.6% over the forecast period. In addition, the well-established market for the production of pulp and paper in North America is further likely to support the market.

LIGNIN MARKET SIZE, SHARE &

TRENDS ANALYSIS REPORT

Report Overview

The global lignin market size was estimated at USD 954.5 million in 2019 and is expected to expand at a CAGR of 2.0% in terms of revenue, from 2020 to 2027. Increasing demand for lignin in animal feed and natural products is anticipated to drive the growth. The product is widely utilized in the production of macromolecules used in the development of bitumen, biofuels, and bio-refinery catalysts. This factor is likely to support market growth. Growing demand for concrete admixtures and adhesives and binders coupled with increasing investments in infrastructure development is expected to fuel the market growth.

In U.S., the demand for lingo-sulphonates accounted for the largest market share of 85.5% in 2019 and is expected to expand at a CAGR of 1.6% over the forecast period. In addition, the well-established market for the production of pulp and paper in North America is further likely to support the market.

learn more about this report, request a free sample copy

Rising trend of using lignin as fuel for burning to use it in multiple applications like dispersants, binders, and adhesives is anticipated to augment the market growth in the forthcoming years. On a macro-level, factors such as increasing construction expenditure and rising demand for automobiles, electronics, and equipment manufacturing are expected to support the demand for lignin. In Europe, the presence of a favorable regulatory framework for the use of lignin in a wide array of commercial applications is expected to be a key factor driving the market growth. The Asia Pacific, on the other hand, is anticipated to witness the fastest growth over the forecast period as a result of rapid industrialization and rising demand for electronics and automobiles. Numerous players operating in the market engage in the full service for lignin and its applications. For instance, Nippon Paper is engaged in pulp and paper manufacturing and derive lignin during the pulping process. In addition, the company is engaged in forest cultivation and industrial plantations.

Product Insights

Ligno-sulphonates emerged as the largest product segment in the lignin market in 2019 and is estimated to maintain its dominance throughout the forecast period. Increased application of concrete mixtures in China, India, and the U.S. on account of improvement in the construction sector are anticipated to fuel demand for lignosulfonates, thereby supporting the growth of the product segment. Reducing use of crude oil containing phenolic resins and carbon fibers has increased the penetration of bio-based raw materials, which is likely to drive the demand for lignin. Moreover, the market players are focusing on investments in R&D to manufacture the product for construction applications.

Sulfur-free lignin products are anticipated to witness an increased demand in the automotive and construction industries in North America, owing to increasing demand for dispersant. Ascending the application of lignin as a dust suppressor is likely to open new avenues for market players in the forthcoming years.

The increasing importance of biofuels in Europe and North America on account of regulatory support to reduce air pollution and decreasing levels of Greenhouse Gas (GHG) emissions is expected to fuel the demand for Kraft lignin over the forecast period. Increase in the manufacturing of carbon fiber, activated carbon, vanillin, phenol derivatives, and phenolic resins is expected to boost the demand for organosolv lignin.

Thinking of starting a sustainability project with us?